SHRI/RDS

2013 Survey on Business Prospects/Wage Increase/Bonus & Views on

Population/Productivity Concerns.

|

1.0

Introduction RDS surveyed 147 companies in June 2013 to find out about their business

prospects, wage, bonus and recruitment plans. Companies were also asked for their views on the tightening of foreign

labour policies use of the wage credit scheme, solution to the low fertility

problem and overcoming productivity barriers. 2.0

Summary of Key Findings Companies

generally still optimistic despite lingering worries. 2.1

Most companies are cautiously optimistic. This is

reflected in moderate wage increases, bonuses and recruitment plans that are

broadly similar to those of the second half of last year. 2.2

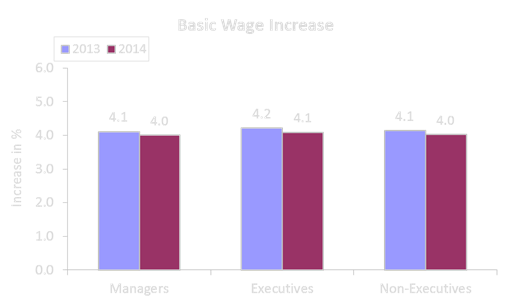

This year’s basic wage increase will average 4.1%

slightly higher than last year’s 4.0%. For next year 2014, it is expected to

be slightly lower at 4%. 2.3

This year’s variable bonus (excluding AWS) will

average 1.7 to 2.0 months. For 2014, they are expected to be 1.8 to 2.0

months 2.4

Total wage increase for this year is expected to

be 4.2%, and with the Consumer Price Index expected to be 2 to 3%; there will

be 1.2 to 2.2% increase in real wages. For

next year, the total wage increase is expected to be 4.1%, and with inflation

expected to be around 3.1%, real wages are expected to increase by 1.0% 2.5

On recruitment, 75% of companies hired or planned

to hire staff this year, slightly lower than the 78% last year. 2.6

Compared to last year, fewer companies retrenched

or planned to retrench this year. For

next year, many companies are not able to make any projection on retrenchment

although 1% of companies, so far, expect to retrench. 2.7

This year, staff turnover is reported at 5 to 7%,

very similar to the 5 to 8% last year. For next year, staff turnover is

expected to be 4 to 7%. 2.8

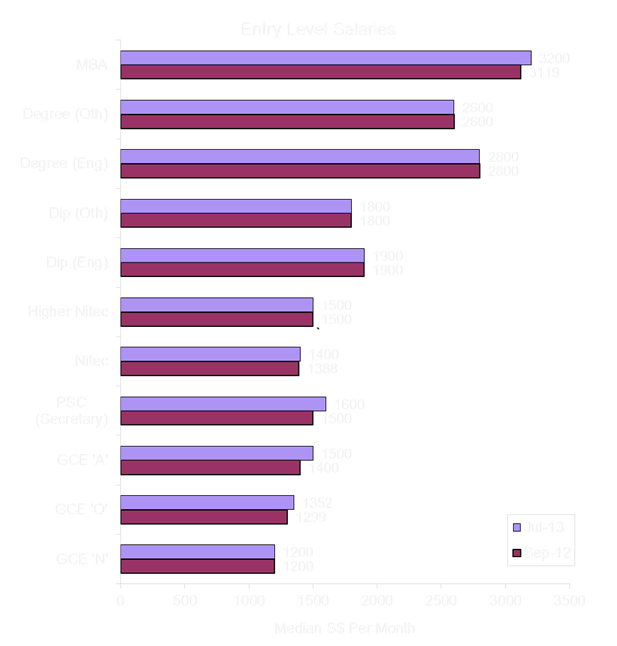

Entry level salaries for GCE ‘O’, GCE ‘A’, PSC

(Secretary), Nitec and MBA qualifications increased

by 0.9% to 7.1% compared to last year; while those for GCE ‘N’, Higher Nitec, Diploma and Degree remained unchanged. 2.9

On the issues of tightening foreign worker

policies, the Wage Credit Scheme (WCS), reduced fertility and productivity

barriers, almost all of the companies surveyed weighed in with their views. These

views are very interesting and wide-ranging – they range from insightful to

the somewhat expected and surprising. 2.9.1 On

the impact of tightened foreign worker policies, most companies (57%) think it

will result in higher wages for lower-skilled workers – what is surprising is

that only 19% think this will dampen economic growth. 2.9.2 On

the use of the WSC, one-third of companies will increase wage increment while

most of the rest will use it to increase either welfare benefit or bonus. 2.9.3 To

solve the reduced fertility problem, many companies feel that living and

child-upbringing costs need to be reduced together with more flexi-work –

what is surprising is that only 18% think more leisure time for younger workers

is needed. 2.9.4 On

overcoming productivity barriers, not surprisingly, streamlining of work

processes and use of appropriate technology top the list. Somewhat

surprisingly, the emphasis of group rather than individual productivity and

the promotion of collaborative work-culture are also highly called for. More effective top management incentives ranks very lowly

with only 15% citing their importance.

3.0 Key

Findings 3.1 Business Prospects Current: 85% of companies reported

satisfactory or better business prospects compared to 78% in September last

year. -

the

most satisfied sector is Engineering & Related. Less companies

reported unsatisfactory business prospects 15% compared to 21% in September

last year. -

the

least satisfied sector is Consumer Products/Retail Overall, most

companies are optimistic. Compared to last

year, more companies are satisfied except for the US companies (78% of US

companies reported satisfied, compared to 88% last year). Large companies

are faring better than the rest (94% satisfied or better compared to 82% of

small and medium-sized companies). Next

6 months: 16% of companies expect

prospects to improve, 76% expect no change while 8% expect prospects to

worsen. -

Engineering

& Related is the most optimistic sector, -

Logistics

sector is the most pessimistic.

Japanese companies are most optimistic over next 6 months, (were

the least optimistic last year) while European & local companies are the

least optimistic. In terms of size, large companies are

the most optimistic. 3.2 Basic Wage Increase The wage increase this year (2013) will

average 4.1%, slightly higher than

the 4.0% projected in September 2012. Highest Paying Sector : General

Manufacturing (4.4 to 5.5%) Lowest Paying Sector : IT/HiTech (3.5% to 3.6%). This year, 7% of the

companies have frozen or plan to freeze wages, and none has cut or plan to

cut wages. For 2014, the wage

increase is projected to be slightly lower at 4.0%.

For 2014, the sector

projecting the highest wage increase of 4.4% to 5.4% is General

Manufacturing. And for the lowest wage increase, it is the 2.6 to 3.6% of the

Electronics sector. 3.3 Variable Bonus

(excluding AWS) For 2013, the variables bonuses

are expected to average at: 2.0 months for Managers 1.8 months for Executives 1.7 months for

Non-executives. Highest Paying Sector -

Engineering & related (2.8 months; higher than the 1.7 to 2.2 months,

reported in Sep 2012) Lowest Paying Sector -

Electronic sector at 0.6 to 0.7 month. Large companies will pay

somewhat higher bonuses (2.0 to 2.5 months) than the 1.5 to 2.0 months of the

small and medium-sized companies. More companies expect to

pay bonuses this year, 92% compared to the 89% last year. For next year 2014, 79%

of companies expect to pay some form of bonus and the bonuses are expected to

increase slightly to: 2.0 months for managers 1.9 months for executives

and 1.8 months for

non-executives. The highest bonus paying

sector next year will still be Engineering and related which expect to pay an

average of 2.7 months while the lowest paying sector, will continue to be

Electronics sector at 0.6 to 0.7 month. 3.4 AWS In 2013, 86% of companies will pay an

average of one month while for next year only 80% of companies expect to do

so. 3.5 Recruitment A total of 75% of the companies hired or will

hire staff this year, slightly lower, compared to the 78% of last year. For next year 2014, less companies (52%) plan to

hire staff. The numbers to be hired for non-managerial staff are somewhat

higher. The average number recruited per company in 2013 and the number

to be recruited next year are:

18% of companies this year are freezing recruitment and for next

year, 14% expect to freeze recruitment. 3.6 Retrenchment This year 8% of companies retrenched or plan to

retrench, fewer than the 12% last year -

surprisingly, it is the Chemicals

& related sector which has the highest rate of retrenchment with about

40% of companies retrenching or expecting to retrench this year. For next year, only 1% of the companies, so far,

plan to retrench. 3.7 Staff

Turnover 86% of companies experienced staff turnover in 2013, slightly

higher than the 84% last year. The annual turnover rate for this year will average: 5% for Managers 6%for Executives and 7% for Non-Executives. For next year, 51% of companies are likely to

experience staff turnover with the turnover rate expected to be slightly

lower. 3.8

Total Accumulated Monthly Variable Component (MVC) in % Fewer companies, 48% of

companies currently pay the MVC and the average accumulated amount is more

than last year, 9.0% for Manager (8.5% in

year 2012) 8.6% for Executives 8.5% for Non Executives.

3.9

Entry-Level Salaries

Entry-level salaries for

GCE “O”, GCE “A”, PSC (Secretarial), Nitec and MBA

qualifications increased by 0.9% to 7.1% compared to September 2012. Those for GCE “N”, Higher

Nitec, Diploma and Degree remained unchanged. 3.10 Impact of Tightened Foreign Worker

Policies Not surprisingly, 57% of companies feel the main impact

would be higher wages for lower-skilled workers – for labour-intensive

sectors like construction, services, consumer products/retail, the

proportions are much higher (60% to 100%) . However, only 30% feel that this would lead to

restructuring of lower-skilled work and 24% feel that it would result in

increased employment of home-makers/elderly. 19% of companies expect that economic growth will be dampened

while 18% expect increased outsourcing of lower-skilled work – for both these

two impacts, the proportion of Construction companies is 60%.

3.11 Use of Wage Credit Scheme (WCS) Surprisingly, only one-third of companies will use it to

increase the wage increment while another 21% will spend it on welfare

benefit and 17% on bonus.

3.12 Solution to Low Fertility Rate More pro-active government efforts to lower

living costs (65%), reduction of child-upbringing costs (65%), more government

funds for child-upbringing & related needs (64%) and more flexi-work

(56%) top the list of solutions. Surprisingly, more leisure time for

younger workers is last on the list as only 18% feel this would be a

solution.

3.13 Overcoming Productivity Barriers Not surprisingly, streamlining of work processes

(79%), use of appropriate technology (63%) top the list of things to do to

overcoming productivity barriers. What is surprising is the relative high ratings of

group rather than individual productivity and promotion of collaborative work

culture at 55% and 54% respectively with improving of employee work-life

balance rated by 52% of companies. Next are increases in: soft-skills/collaborative training (48%), respect/recognition/career advancement for

workers (45%), worker participation in

decision-making/innovation (44%) & adoption of HR best practices (42%). Surprisingly, not many companies cite the need

for: increase in capital investment (18%) reduction of wage disparity (16%) more effective top management incentives (15%)

and increase of foreign labour/talent (7%).

If you wish to participate in any of our future surveys, click here |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||