HCS/RDS 2016/2017

Survey on Business Prospects/Wage Increase/Bonus & Manpower-Lean Issues.

|

1.0

Introduction HCS and RDS surveyed 89

companies in July 2016 to find out about their business

prospects, wage, bonus and recruitment plans. Companies

were also asked for their views on manpower-lean issues. 2.0

Summary of

Key Findings 2.1 Not surprisingly, companies are

slightly less optimistic than last year but not very much so, and, as

expected, they are still somewhat careful on wage increases, bonuses and

recruitment. 2.2 This

year’s basic wage increase averaged 3.2% slightly lower than the 3.5% to

4.0 % last year; - for 2017, it

is expected to be slightly higher at 3.4%. 2.3 This

year’s variable bonuses (excluding AWS) will average 1.5 to 1.8 months; - for next year, they are also likely to

be marginally lower at 1.4 to 1.6 months 2.4 The total

wage increase for 2016 is 3.6%, and with the Consumer Price Index at minus

0.4%; the real wage increase is 4.0%; - for next year, the total wage increase

is expected to be 2.2%, and with CPI expected to be around 1.0%, real wages

are expected to increase by 1.2%. 2.5 This year,

a total of 75% of companies hired staff, slightly less than the 78% in 2015; - for next year, although less (58%)

companies plan to hire staff the average number of executives and

non-executives to be hired are slightly higher than this year’s 2.6 More

companies retrenched this year, 12% of the companies compared to 8% in 2015 - for next

year, none of the companies, plan to retrench. 2.7 This year,

87% of companies experienced staff turnover; although this is slightly more

than the 86% last year, the average turnover rates are slightly lower than

last year’s. - for next year fewer companies (57%)

are likely to experience staff turnover and the turnover rates are also

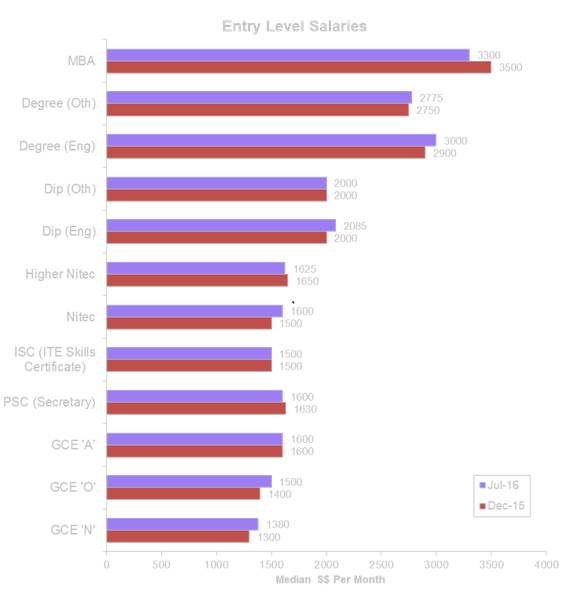

expected to be slightly lower 2.8 Entry-level

salaries were quite mixed; those for MBA decreased by $200 while those for

GCE, NITEC, Dip(Eng) and

Degree(Eng) went up by $80 to $100 and the rest

were either unchanged or went up slightly. 2.9 On the

issue of manpower-lean policies, 51% of companies are already implementing

them with 28% still considering and 16% not sure. - as for the essential steps to take for

implementation, most cite: continuous

review of processes and technology and opening up of communications and

making processes more transparent - sure enough, there are many anxieties

and problems involved ranging from perception gaps to job security fears,

distrust and lack of knowhow; interestingly, “HR-not-up-to-task” was not

cited. 3.0 Key

Findings 3.1 Business

Prospects Current: 72% of companies reported satisfactory or better business

prospects compared to 76% last year -

the

most satisfied sectors are F&B/Hotels and Construction & Related More companies reported unsatisfactory business

prospects 28% compared to 24% last year. -

the least

satisfied sector is still Consumer Products/Retail, similar to last year.

European companies were the most satisfied (90%

satisfied or better) followed by Japanese (85%), US companies (70%) and Local

companies (66%),Asia Pacific companies were the least

satisfied (55%). Large companies fared better than the rest (83%

satisfied or better compared to 65% of small and 71% of medium-sized

companies). Next 6 months: 12% of companies expect prospects to improve, 67% expect no change

while 20% expect prospects to worsen -

F&B/Hotels and IT/HiTech are the

most optimistic, -

Electronics & Related sector is the least optimistic.

Asia Pacific companies are most optimistic over

next 6 months, while Japan companies are the least optimistic. In terms of size, large and small companies are

relatively more optimistic, compared with the medium-sized companies 3.2 Basic

Wage Increase More companies granted

wage increases 97% compared to 91% last year; the wage increases, however are

slightly lower at 3.2% compared

to the 3.5 to 4.0% in 2015. Highest Paying Sector : Engineering & Related (3.6 to 4.5%) Lowest Paying Sector : Logistics

(1.9 to 2.3%). In 2016, 1% of the companies cut wages; more companies froze wages, 13% of companies compared to 9% in 2015. For next year, the wage

increase will average 3.4% with 4% of companies planning to freeze wages; and 1%

of companies planning to cut wages.

For 2017, the sector expecting the highest wage increase

is Engineering & Related (3.9% to 4.1%). And Financial &

Related sector expects to have the lowest wage increase, 2.5 to 3.2%. In terms of both company

size and nationality, wage increases are relatively similar and do not vary

very significantly. 3.3 Variable

Bonus (excluding AWS) For 2016, 85% of companies (92% in 2015) paid variable

bonuses which are marginally lower than last year’s, averaging: 1.8 months for Managers 1.7 months for Executives 1.5 months for Non-executives. Highest

Paying Sector – General Manufacturing (2.2 to 3.2 months) Lowest

Paying Sector – Logistics

(0.6 months) Large companies paid

higher bonuses (1.9 to 2.4 months) than the 1.2 to 1.8 months of the small

and medium-sized companies. For next year 2017, 82% of companies expect to pay some form of bonus and the bonuses are

expected to be slightly lower averaging: 1.6 months for managers 1.6 months for executives

and 1.4 months for non-executives.

The

highest bonus paying sector next year will continue to be General

Manufacturing sector which expect to pay bonuses at 2.0 to 2.9 months while

the lowest paying sector, will continue to be Logistics sector at 0.3 months. In 2016, 91% of companies

will pay 0.9 to 1

month of AWS

while for next year 90% of companies expect to

pay the AWS of 1 month.

3.5 Total/Real Wage Increase Total wage increase is

total wage (annual base plus AWS and variable bonus) of current year divided

by that of the previous year. With 91% of companies

paying AWS, total wage increase for 2016 is 3.6% and with the Consumer Price

Index at minus 0.4% (as at June 2016), the real wage increase is 4.0% For next year, as 90% of

companies expecting to pay AWS, total wage increase for 2017 is expected to

be 2.2%. The real wages are expected to be increase by 1.2%, after factoring

in the CPI projection of 1.0%

3.6 Recruitment In 2016, a total of 75% of companies hired staff, slightly

less than the 78% in 2015. For next year, 58% of companies plan to hire staff. The average number recruited

per company in 2016 and the number to be

recruited next year are:

More companies froze or

plan to freeze recruitment 45% this year (compared to 27% in 2015); for next year, 34% of the companies expect to freeze

recruitment. 3.7 Retrenchment More companies retrenched

this year, 12% of companies compared

to 8% in 2015. For next year, none of the companies, so far, plan to retrench. 3.8 Staff Turnover This year, 87% of companies experienced staff turnover;

although this is slightly more than the 86% last year, the average turnovers

rates are slightly lower than last year’s.

The annual turnover rate

for 2016 will average: 4% for Managers 8% for Executives and 7% for

Non-Executives. For next year fewer

companies (57%) are likely to experience staff turnover and the turnover rate

is also expected to be slightly lower. 3.9 Total

Accumulated Monthly Variable Component (MVC) in % of Monthly Salary Slightly more companies,

60% compared to 56% in 2015, paid the MVC. The average accumulated amount is

less than the 10.0 to 10.5% in 2015. In 2016 the MVC averaged: 8.1% for Manager 8.1% for Executives 8.3% for Non Executives.

3.10

Entry-Level Salaries

Entry-level

salaries for PSC(Secretary) and Higher Nitec decreased by $25 to $30; while those for MBA

decreased by $200. GCE ‘N’, GCE

‘O’, Nitec, Diploma(Engineering)

and Degree(Eng) saw increases of $80 to $100;

Degree(Others) went up by $25 while those for GCE ‘A’, ISC(ITE Skills

Certificate) were unchanged. 3.11 Manpower-Lean Policies 3.11.1

51% of companies are

already implementing manpower-lean policies with 28% still considering and

16% not sure. 3.11.2

Understandably, companies

and their employees have anxieties or are having problems with the issue: almost half (48%) cite

perception gaps among employees and management and another 48% cite job

security fears 17% cite distrust between

employees and management 15% say they lack

implementation knowhow 14% cite possible

internal divisiveness 14% cite management inertia 12% cite potential for

downsizing abuse. Interestingly, no Company

mentioned that HR is not up to the task. 3.11.3

The steps that are

considered essential for successful implementation and the proportion of

companies citing them are:

If you wish to participate in any of our future surveys, click here |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||