SHRI/RDS

2014 Survey on Business Prospects/Wage Increase/Bonus & Missing Link in

Productivity.

|

1.0

Introduction RDS surveyed 123 companies in December 2013 to find out about their business

prospects, wage, bonus and recruitment plans. Companies were also asked for their views on the missing link

(employee attitude & organisational culture) in productivity. 2.0

Summary of Key Findings 2.1

Companies are slightly more optimistic than six

months ago but are still somewhat careful on wage increases, bonuses and

recruitment. 2.2

2013’s basic wage increase averaged 4.1 to 4.3% slightly higher than the

4.0% in 2012; -

for

2014, it is expected to be similar to last year’s levels at around 4.1 to

4.2%. 2.3

Last year’s variable bonus (excluding AWS)

averaged 1.8 to 2.1 months; - for 2014, they are also likely to be

maintained at 1.8 to 2.1 months 2.4

The total wage increase for 2013 was 5.0%, and

with the Consumer Price Index at 2.4%; the real wage increase was 2.6%; - for this year, the total wage increase

is expected to be 4.0%, and with CPI expected to be around 2.8%, real wages

are expected to increase by 1.2% 2.5

On recruitment, 81% of companies hired staff in

2013, higher than the 78% in 2012; - this year, however, not only are there less companies

hiring (67%) but the number to be hired is also expected to be lower. 2.6

Fewer companies retrenched, 6% in 2013 compared

to the 12% in 2012. - for this year

only 4% of companies, so far, expect to retrench. 2.7

Staff turnover was higher in 2013 than the year

before; - for 2014, less

companies are expected to experience staff turnover, 54% compared to 90% in

2013 and the turnover rate is also expected to be slightly lower. 2.8

Entry-level salaries hardly increased except for

GCE ‘O’ and Higher Nitec qualifications which

increased by only $50 compared to six months ago. 2.9

On the missing link to productivity, it is interesting

that while practically all companies agree that Employee Attitude and

Organisational Culture affect productivity, less than a third think that

emphasis on HR practices is paramount; - we think this

is a disconnect between what HR and top management truly believe and practise

and unless this is bridged, companies are missing out on this crucial link in

productivity improvement.

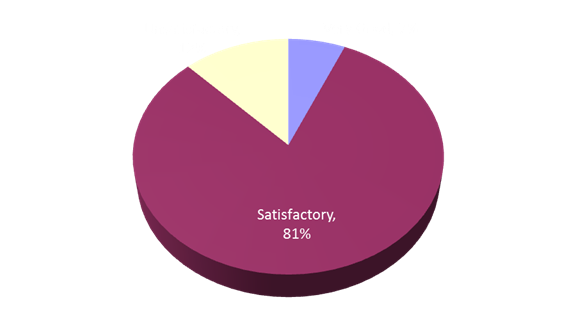

3.0 Key Findings 3.1 Business Prospects Current: 88% of companies reported satisfactory

or better business prospects compared to 85% in June last year -

the

most satisfied sectors are Construction, Education, F&B/Hotels and IT/HiTech. Fewer companies

reported unsatisfactory business prospects 12% compared to 15% six months ago -

the

least satisfied sector is still Consumer Products/Retail, similar to six

months ago.

European companies were the

most satisfied (100% satisfied or better) followed by Japanese (96%) and

local companies (84%). US companies were the least satisfied (78%). Large companies fared better

than the rest (97% satisfied or better compared to 83% of small and

medium-sized companies). Next 6 months: 23% of companies expect

prospects to improve, 73% expect no change while 4% expect prospects to

worsen. -

Trading

is the most optimistic sector, -

Electronics

sector is the least optimistic.

European

companies are most optimistic over next 6 months, (were the least optimistic

last year) while US companies are the least optimistic. In terms of size,

large and small companies are optimistic, while medium companies are least

optimistic. 3.2 Basic Wage Increase The wage increase

in 2013 averaged 4.1 to 4.3%,

higher than the 4% in 2012. Highest

Paying Sector : Financial/Insurance (6.7 to 8.4%) Lowest Paying Sector : Construction

and Related (2.6%). In 2013, 3% of companies

froze wages, less than the 11% in 2012. For this year 2014, the

wage increase will average 4.1 to 4.2% with only 2% of the companies planning

to freeze wages; as for wage cut, no company is planning to do so.

For 2014, the sector

expecting the highest wage increase continues to be Financial/Insurance (5.9%

to 6.9%). And for the lowest wage increase, it is the 3.2 to 3.5% of the

Logistics sector. While large companies expect a wage increase

of only 3.9% this year, the medium and small companies expect to pay 4.1 to

4.5 %. Asia Pacific companies,

on the other hand, which paid the highest increases of 5% to 6% also expect to pay the highest increases of 5 to 5.7%

this year. 3.3 Variable Bonus

(excluding AWS) For

2013, the variables bonuses averaged: 2.1

months for Managers 1.9

months for Executives 1.8 months for

Non-executives. Highest

Paying Sector – Oil & Gas (2.4 to 3.4 months) Lowest

Paying Sector – Consumer Products/Retails at 0.8 month Large companies paid higher

bonuses (2.3 to 2.7 months) than the 1.5 to 1.8 months of the small and

medium-sized companies. Slightly more companies in

2013 paid bonuses, 90% compared to the 89% in 2012. For

this year 2014, 82% of companies expect to pay some form of bonus and the

bonuses are expected to be: 2.1

months for Managers 1.9

months for Executives and 1.8 months for

Non-executives.

The highest bonus paying sector next year

will be Financial/Insurance sector which expect to pay bonuses at 2.9 to 3.4

months while the lowest paying sector, will continue to be Consumer

Products/Retails sector at 0.8 months. In 2013, 85% of companies paid an average of 1.1 month while for

next year only 82% of companies expect to pay the AWS. 3.5 Recruitment In 2013, a total of 81% of the companies hired staff, higher

than the 78% in 2012. For this year 2014, 67% of the companies plan to hire staff. The average number recruited per company in 2013 and the number

to be recruited this year are:

16% of companies froze recruitment in 2013 and for this year,

15% expect to freeze recruitment. 3.6 Retrenchment 6% of companies retrenched in 2013, slightly fewer than the 12%

in 2012. For this year, 4% of the companies, so far, plan to retrench. 3.7 Staff

Turnover Last year, 90% of companies

experienced staff turnover, higher than the 84% in 2012. The annual

turnover rate for 2013 averaged: 5% for Managers 8%for Executives

and 9% for Non-Executives. For this year less companies (54%) are likely to experience staff

turnover and the turnover rate is also expected to be slightly lower. 3.8

Total Accumulated Monthly Variable Component (MVC) in % Slightly more

companies, 53% compared to 56% in 2012, paid the MVC in 2013 and the average

accumulated amount is more than the 7.8 to 8.5% in 2012. In 2013 the MVC

averaged: 9.5% for Manager 9.2% for

Executives 9.4% for Non Executives.

3.9

Entry-Level Salaries

Little change in Entry-level salaries,

compared to six months ago. There was only a slight increase of $50 or 3.3%

to 3.6% for GCE “O” and Higher Nitec holders. 3.10 Missing Link in Productivity &

Innovation Improvement When Microsoft abolished employee ratings recently in order to

improve teamwork and innovation, we were reminded that some companies only

pay lip service to HR practices so we set out to find out how many companies

truly believe in good HR practices and “walk the talk”. And, although, international research and our surveys have shown

time and time again that employee attitude, satisfaction and commitment have

a great impact on productivity and innovation, these

factors are hardly the focus and priority of top management. Hopefully by asking companies how important really are Employee Attitudes and Organisational

Culture and which management practice affect productivity most, we would get

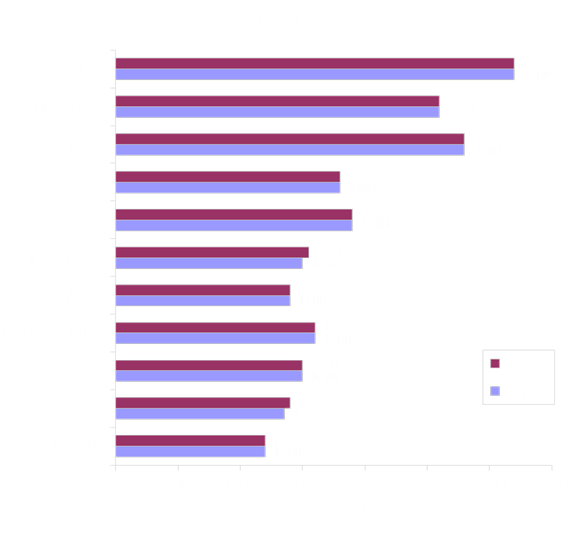

an idea. The results are somewhat surprising. While practically all companies agree that Employee Attitudes

and Organisational Culture affect productivity, it is somewhat surprising

that less than a third of companies think that emphasis on HR practices is

paramount. Consequently, there is a disconnect

between what HR can do and what top management actually does. It is apparent

that unless HR can influence top management to “walk the talk”, they are

missing out on this crucial link in productivity & innovation

improvement. 3.10.1 Employee Attitudes and Organisational Culture 98% of companies agree employee attitudes can affect

productivity, while the other 2% are unsure. For Organisational Culture, 97% of companies agree it can affect

productivity, while 1% disagreed. 3.10.2 Managerial Practice that Most affect Productivity

If you wish to participate in any of our future surveys, click here |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||