RDS

2014/2015 Survey on Business Prospects/Wage Increase/Bonus & Skills vs

Degree.

|

1.0

Introduction RDS surveyed 110 companies in October 2014 to find out about their

business prospects, wage, bonus and recruitment plans. As productivity is still an ongoing concern, Companies were also asked

for their views on how they are investing to improve productivity. As for the

skills vs degree qualification issue their views were also sought as this

issue is particularly important to both employees and employers. 2.0

Summary of Key Findings - Fourth Year of Cautious Optimism 2.1 Companies

are slightly less optimistic than a year ago so it is no surprise that they

continue to be careful on wage increases, bonuses and recruitment as they

have been for the last four years since 2010 after the recovery from the

global financial crisis. 2.2 The

wage increase in 2014 averaged 4.1 to

4.3%. This increase is not only similar to last year’s but also that of

the past four years. Not surprisingly next year’s increase is also projected

to be around the same but slightly lower range of 3.9 to 4.1%. 2.3 This

year’s variable bonus (excluding AWS) will average 1.7 to 2.1 months; -

for 2015, they are likely to be slightly lower at

1.6 to 2.0 months 2.4 The

total wage increase for 2014 is 4.3%, and with the Consumer Price Index at

1.8%; the real wage increase is 2.5%; -

for 2015, the total wage increase is expected to

be 3.3%, and with CPI expected to be around 2.2%, real wages are expected to

increase by 1.1% 2.5 This

year, 83% of the companies hired staff, higher than the 80% in 2013; -

next

year, however, not only are there less companies intending to hire (65%) but the number to be hired is also expected to be

lower. 2.6 More More

companies retrenched staff this year, 10% of the companies compared to the 6%

in 2013; for next year only 1% of the companies, so far, plan to retrench. 2.7 This

year, 86% of companies experienced staff turnover, less than the 90% in 2013;

next year, fewer companies (50%) are likely to experience staff turnover and

the turnover rate is also expected to be slightly lower. 2.8 Vocational

entry-level salaries including those for diploma (Engineering) and Degree

(Others) increased by 3 to 7% compared to last year. 2.9 To

improve productivity most companies are investing in task-oriented measures

like work processes and training rather than work culture. However, this may

be somewhat

unfortunate as having the right culture can

not be over-stated as it has an important impact on all other

productivity-related factors. 2.10 On

the question of Skills vs Degree Qualification, most companies (96%)

responded that job-fit/skills are not only emphasised over and above degree

qualification but practically all of them have undertaken some measures to

reinforce this such as providing continous

learning/training and recruiting for job-fit/skills rather than sheer

qualifications.

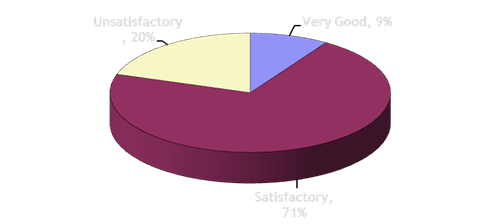

3.0 Key Findings 3.1 Business Prospects Current: 80% of companies reported satisfactory

or better business prospects; this is lower than the 88% in December 2013; - the most

satisfied sectors are Chemicals, F&B/Hotels, Healthcare/Pharmaceuticals

and Services. More companies reported

unsatisfactory business prospects 20% compared to 12% last year. - the least

satisfied sector is still Consumer Products/Retail, similar to last year.

Japanese and US companies were

the most satisfied (90% satisfied or better) followed by European (83%) and

Asia Pacific companies (75%). Local companies were the least satisfied (72%).

Large companies fared better

than the rest (90% satisfied or better compared to 71% of small and

medium-sized companies). Next 6 months: 15% of companies expect

prospects to improve, 79% expect no change while 6% expect prospects to

worsen. - Marine/Shipping is the most optimistic

sector, - Engineering sector is the least

optimistic.

Japanese

companies are most optimistic over next 6 months, while US

and Local companies are the least optimistic. In

terms of size, large companies are optimistic, while medium and small

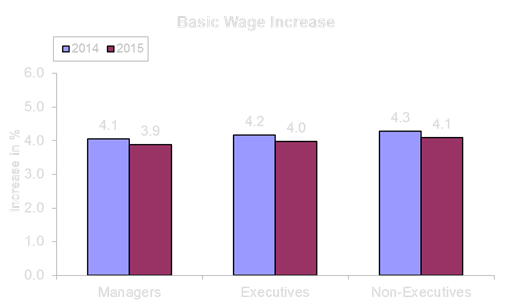

companies are least optimistic. 3.2 Basic Wage Increase The wage increase

in 2014 averaged 4.1 to 4.3%

similar to that of last year. Highest

Paying Sector : Trading (4.6 to 5.2%) Lowest Paying Sector : Electronics

(2.8 to 3.3%). In 2014, 1% of the

companies cut wages; more companies froze wages 7% of companies compared to

3% in 2013. For next year 2015 it is

projected to be also around this range but slightly lower at around 3.9 to 4.1%.

For 2015, the sector

expecting the highest wage increase continues to be Trading (4.2% to 5.0%).

And Electronics sector continues to be the lowest wage increase, 2.6 to 3.0%.

While large companies

expect a wage increase of only 3.9% this year, the medium sized companies

expect to pay 4.0 to 4.3 %. Small companies expect a smaller

wage increase (3.7 to 4.0%) compared to last year (4.2 to 4.5%). Overall, Japanese

companies which paid the highest increases of 4.1 to 4.5% also expect to pay

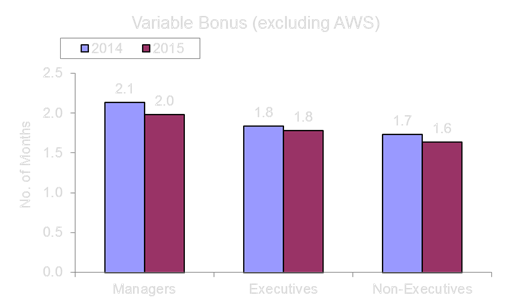

the highest increases of 4.1 to 4.3% for 2015. 3.3 Variable Bonus

(excluding AWS) For

2014, the variables bonuses will average: 2.1 months for

Managers 1.8 months for

Executives 1.7 months for

Non-executives. Highest

Paying Sector – Healthcare/Pharmaceuticals (2.7 to 3.0 months) Lowest Paying Sector –

Electronics (0.7 to 1.1 months) Large

companies will pay higher bonuses (2.6 to 3.1 months) than the 1.4 to 1.9

months of the small and medium-sized companies. Slightly

less companies paid bonuses, 88% compared to 90% in 2013. For

next year 2015, 83% of companies expect to pay some form of bonus and the

bonuses are expected to be: 2.0 months for

managers 1.8 months for

executives and 1.6 months for

non-executives.

The highest bonus paying

sector next year will be Logistics sector which expect to pay bonuses of 2.8

to 3.8 months while the lowest paying sector, will be Consumer

Products/Retails sector at 0.7 to 0.9 months. The wage increase in 2014

is 4.3 % and for next year it is expected to be 3.3%. With CPI this year expected

to at 1.8%, the real wage increase this year is around 2.5% while next year

it is projected to be lower at 1.1%. In 2014, 88% of companies paid an average of 1.1 month while for

next year only 85% of companies expect to pay the AWS 3.6 Recruitment In 2014, a total of 83% of the companies hired staff, higher

than the 80% in 2013. For next year 2015, 65% of the companies plan to hire staff. The average number recruited per company in 2014 and the number

to be recruited next year are:

17% of companies froze recruitment in 2014 and for next year,

15% expect to freeze recruitment. 3.7 Retrenchment More companies retrenched staff this

year, 10% of the companies compared to the 6% in 2013. For next year only 1% of the companies, so far, plan to

retrench. 3.8 Staff

Turnover This year, 86% of companies

experienced staff turnover, less than the 90% in 2013. The annual

turnover rate for 2014 averaged: 5% for Managers 8%for Executives

and 8% for

Non-Executives. For next year fewer companies

(50%) are likely to experience staff turnover and the turnover rate is also

expected to be slightly lower. 3.9

Total Accumulated Monthly Variable Component (MVC) in % of Monthly Salary Slightly fewer

companies, 50% compared to 53% in 2013, paid the MVC. The average accumulated

amount is more than the 9.2 to 9.5% in 2013. In 2014 the MVC averaged: 10.0% for Manager

10.0% for

Executives 11.1% for Non

Executives.

3.10

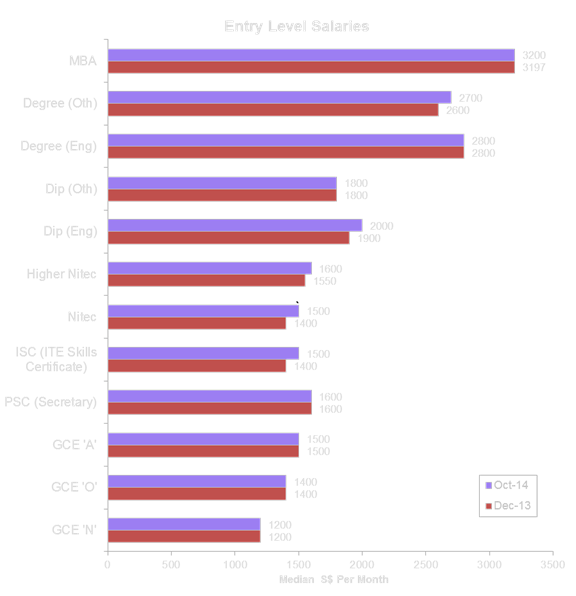

Entry-Level Salaries

Vocational skill qualifications saw

increases in entry level salaries compared to last year as follows: ISC (ITE Skills Certificate) $100 or 7.1% Nitec $100

or 7.1% Higher Nitec $ 50 or 3.2% Diploma (Engineering) $100 or 5.3% and Degree (Others) $100

or 3.8%. 3.11 Investing to Improve

Productivity In our survey last year practically all companies agreed that

employee attitude and organisational culture affect productivity. However,

just over one third actually invest in improving work culture; more companies

invest in task-oriented measures like work processes and training. This is

unfortunate as having the right culture can not be

over-stated as it has an important impact on all other productivity-related

factors. We find companies continuing to invest in:

3.12 Job-Fit/Skills

vs Degree 3.12.1 On

the question of Skills vs Degree Qualification, most companies (96%)

responded that job-fit/skills are emphasised over and above degree

qualification. 3.12.2 The measures that Companies have already

taken to enhance job-fit/skills are:

If you wish to participate in any of our future surveys, click here |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||