HCS/RDS

2015/2016 Survey on Business Prospects/Wage Increase/Bonus & Work Stress.

|

1.0

Introduction HCS and RDS surveyed 90 companies in December 2015 to find out about their

business prospects, wage, bonus and recruitment plans. Companies were also asked for their views on work stress as this is

becoming more prevalent affecting not only worker health and safety but also

productivity and profits. 2.0

Summary of Key Findings - Fifth Year of Cautious Optimism

2.1 Despite

the lack of cheer and continuing glum about the economy, the good news is

that companies are only slightly more cautious compared to last year. 2.2 2015’s

basic wage increase averaged 3.5 to

4.0% slightly lower than the 4.1 to 4.3% in 2014, -

for

2016, the basic wage increase is expected to be marginally lower at 3.5 to

3.7 %. 2.3 This

year’s variable bonus (excluding AWS) averaged 1.8 months; - for 2016, it is also likely to be slightly

lower at 1.5 to 1.7 months 2.4 The

total wage increase for 2015 was 3.3%, and with the Consumer Price Index at

minus 0.2%, the real wage increase was

3.5%; - for 2016, the total wage

increase is expected to be 2.7%, and with CPI expected to be around 1.1%,

real wages are expected to increase by 1.6% 2.5 On

recruitment, 78% of companies hired staff in 2015, fewer than the 83% in

2014; - for

2016, however, not only are there less companies hiring (71%) but the number

to be hired is also expected to be lower.

2.6 Fewer

companies retrenched, 8% in 2015 compared to the 10% in 2014 - for 2016 only 3%

of companies, so far, expect to retrench. 2.7 Staff

turnover was lower in 2015 than the year before; - for

2016, less companies are expected to experience staff turnover, 72% compared

to 85.6% in 2015 and the turnover rate is also expected to be slightly lower. 2.8 Work

stress is very prevalent as practically all companies are affected quite seriously

- 74% of management staff and

38% of executive staff are experiencing significant to a lot of stress, but, fortunately,

only 7% of rank and file staff are similarly

affected. 2.9 Causes

of work stress are mainly job demand, tight deadlines, lack of support, long

hours, lack of resources, boss/co-worker relationships and lack of autonomy. 2.10

The steps that companies can and should take to

address these concerns are, fortunately, not very difficult as they involve

mainly top-down initiatives such as regular staff/management review on

job/workload and work stress issues among others.

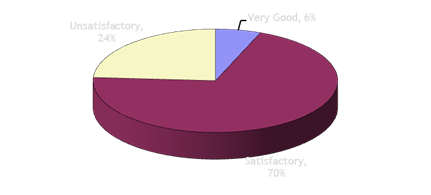

3.0 Key Findings 3.1 Business Prospects Current: 76% of companies reported satisfactory

or better business prospects compared to 80% last year -

the

most satisfied sector was Healthcare/Pharmaceuticals. More companies reported unsatisfactory

business prospects 24% compared to 20% last year -

as

in last year, the least satisfied sector was Consumer Products/Retail.

European companies were the

most satisfied (100% satisfied or better) followed by Japan and Asia Pacific

companies (86%). Local and US companies were the

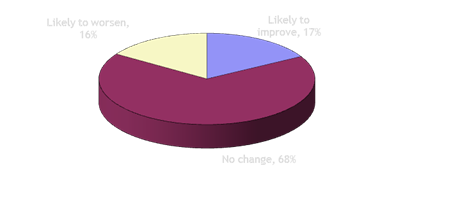

least satisfied (67%). Next 6

months: 17% of companies expect

prospects to improve, 68% expect no change while 16% expect prospects to

worsen - Construction/Property is the

most optimistic sector, - Trading sector is the least

optimistic.

European companies are most

optimistic over next 6 months, while US companies are the least optimistic. In terms of size,

medium-sized companies are optimistic, while large and small companies are

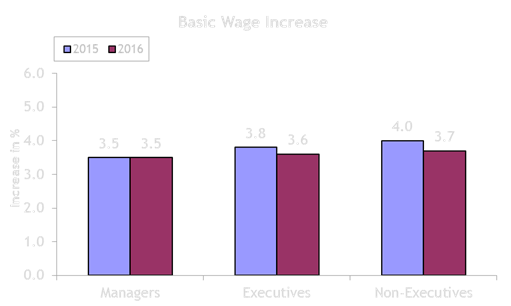

least optimistic. 3.2 Basic Wage Increase The wage increase in 2015 averaged 3.5 to 4.0%,

lower than the 4.1 to 4.3% in 2014. Highest Paying Sector : Construction/Property

(4.2 to 5.3%) Lowest Paying Sector : Consumer

Products/Retail (2.9 to 3.7%). In 2015, 3% of the

companies cut wages; more companies froze wages, 9% of companies compared to

7% in 2014. For next year 2016, the

wage increase will average 3.5 to 3.7% with 7% of the companies planning to

freeze wages and 1% planning to cut wages.

For 2016, the sector

expecting the highest wage increase is Chemicals/Oil&Gas (3.9% to 4.3%) with Financial &

Related sector expecting to have the lowest wage increase, 2.6 to 3.0%. Medium-sized companies

paid the highest wage increases, 3.8 to 4.5% in 2015 while small companies

paid the least (3.1 to 3.4%). Large companies paid wage increase at averaged

of 3.9% in 2014, remain the same this year, and expect to be 3.9 to 4.0% in

2016. Overall, local companies

paid the highest increases of 3.6 to 4.3% in 2015 and for 2016,

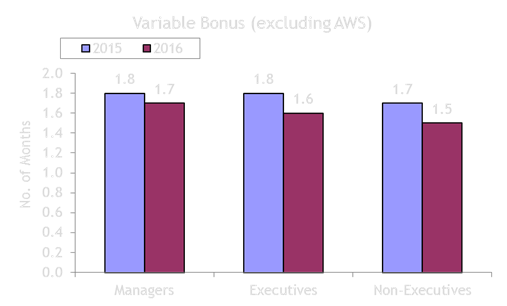

Japanese companies expect to pay the highest increases of 3.8 to 4.0%. 3.3 Variable Bonus

(excluding AWS) For

2015, the variables bonuses averaged: 1.8

months for Managers 1.8 months for

Executives 1.7 months for Non-executives. Highest Paying Sector –

Chemicals/Oil&Gas (3.0 months) Lowest Paying Sector –

Consumer Products/Retails (0.3 to 0.6 months) Large

companies paid higher bonuses (2.2 to 2.4 months) than the 1.4 to 1.8 months

of the small and medium-sized companies.

More

companies paid bonuses this year, 92% compared to the 88% in 2014. For

next year 2016, 84% of companies expect to pay some form of bonus and the

bonuses are expected to be: 1.7

months for managers 1.6 months for

executives and 1.5 months for

non-executives.

The

highest bonus paying sector next year will continue to be Chemicals/Oil &

Gas sector which expect to pay bonuses at 2.3 to 2.4 months while the lowest

paying sector, will continue to be Consumer Products/Retails sector at 0.4 to

0.7 months. In

2015, 88% of companies paid an average of 1 month while for next year 89% of

companies expect to pay the AWS. 3.5 Recruitment In

2015, a total of 78% of the companies hired staff, fewer than the 83% in

2014. For next

year 2016, 71% of the companies plan to hire staff. The

average number recruited per company in 2015 and the number to be recruited

next year are:

More

companies froze recruitment 27% of the companies this year (17% in 2014); for

2016, 30% expect to freeze recruitment.

3.6 Retrenchment Slightly

fewer companies retrenched this year, 8% of the companies compared to 10% in

2014. For next

year, 3% of the companies plan to retrench.

3.7 Staff

Turnover This

year, 86% of companies experienced staff turnover. The

annual turnover rate for 2015 averaged: 6%

for Managers 10% for

Executives and 10% for

Non-Executives. For next year fewer companies (72%) are likely to experience staff turnover and the turnover rate is also expected to be slightly lower. 3.8 Total

Accumulated Monthly Variable Component (MVC) in % of Monthly Salary Slightly

more companies, 56% compared to 50% in 2014, paid the MVC. The average

accumulated amount is less than the 10.0 to 11.1% in 2014. In 2015 the MVC

averaged: 10.5%

for Manager 10.1% for

Executives 9.9% for Non

Executives.

3.9

Entry-Level Salaries

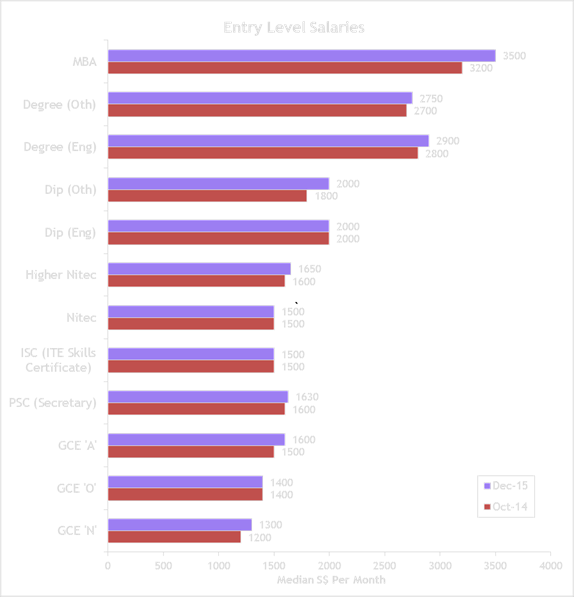

At the lower end, GCE ‘N’ & ‘A’ saw

increases of $100, PSC(Secretary) $30, Higher Nitec $50 while at the tertiary levels, Diploma(Oth) saw increases of $200, Degree(Engineering) $100,

Degree(Oth) $50 and MBA $300. 3.10 Work Stress 3.10.1 Practically all companies reported that their management staff, executives and also the rank and file are experiencing some form of work stress - 74% of management staff are

experiencing very significant to a lot of stress compared to 38% of

executives and only 7% of rank and file. 3.10.2 The main causes of stress are:

3.10.3 The steps that companies can and should take to address work

stress are:

If you wish to participate in any of our future surveys, click here |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||