HCS/RDS 2017 Survey on Business Prospects/Wage Increase/Bonus & CFE

Strategies.

|

1.0

Introduction RDS surveyed 75

companies in April 2017 to find out about their business

prospects, wage, bonus and recruitment plans. Companies

were also asked for their views on the Strategies recommended by the

Committee on the Future Economy (CFE). 2.0

Summary of

Key Findings 2.1 Companies

are slightly more optimistic than last year but, as in previous years, still

cautious on wage increases, bonuses and recruitment. 2.2 2017’s

basic wage is expected to average at 2.9

to 3.1% slightly lower than the 3.2% in 2016; - for 2018, it

is expected to be around 3.2 to 3.3%. 2.3 Variable

bonus (excluding AWS) is expected to average 1.5 to 1.7 months; - for 2018, it is also likely to be

maintained at 1.5 to 1.7 months 2.4 The

total wage increase for 2017 is expected to be 2.7% and with the Consumer

Price Index projected at 0.7%; the real

wage increase will be around 1.9%; 2.5 On

recruitment, fewer companies hired staff this year (65%) compared to last

year (75%), and the numbers hired or to be hired are also lower; - for

2018, not only are there less companies hiring (51%) but the number to be

hired are also expected to be slightly lower.

2.6 Fewer

companies retrenched or planned to retrench, 9% in 2017 compared to the 12%

in 2016. 2.7 Less companies

experienced staff turnover (81% compared to last year’s 87%) and the turnover

rate is also expected to be lower this year;

- for

2018, less companies (53%) are expected to experience staff turnover but the

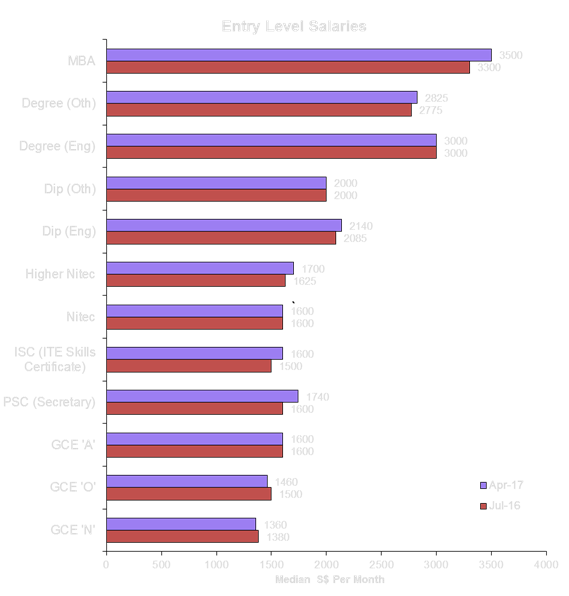

turnover rate is expected to remain the same. 2.8 Entry-level

salaries are generally mixed to slightly higher, two were slightly down, four

remained unchanged and six entry-level salaries increased by about 2 to

5%. 2.9 Of the

seven CFE Strategies, the most relevant to the companies are: Strengthen

enterprise capabilities to innovate and scale up - 60% Acquire

and utilise deep skills - 53% Partner

one another to enable growth and innovation -

41% 2.10

The other strategies that should also be considered are: Adapt/discard

out of date HR policies with evidence-based ones - 55% Use

behavioural science findings to review policies/ regulations -

29% Use

“Nudge” strategies to promote optimal/sustaining behaviours - 28% 3.0 Key

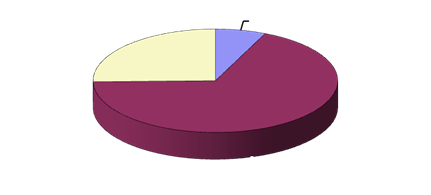

Findings 3.1 Business

Prospects Current: Slightly

more companies (75%) reported satisfactory or better business prospects

compared to last year (72%); - the most satisfied sectors are

Education, General Manufacturing, and

Healthcare & Related. Slightly

less companies (25%) reported unsatisfactory business prospects compared to

28% last year (28%); - the least satisfied sector is Trading.

Asia

Pacific companies are the most satisfied (100% satisfied or better) followed

by US companies (83%), Japan (76%),

and European companies (75%), local companies are the least satisfied

(68%). Large

and medium-sized companies fare better than the small companies (79%

satisfied or better compared to 65% of small companies). Next 6 months: 16%

of companies expect prospects to improve, 75% expect

no change while 9% expect prospects to worsen. -

Education

and Marine/Shipping are the most optimistic sector, -

Logistics

sector is the least optimistic.

US

companies are most optimistic over the next 6 months, while Asia Pacific

companies are the least optimistic. Large

and medium-sized companies are still relatively optimistic, compared with the

small companies. 3.2 Basic

Wage Increase The wage increase in 2017

averaged 2.9 to 3.1% lower than

the 3.2% in 2016. Highest Paying Sector : General

Manufacturing (3.8 to 4.3%) Lowest Paying Sector : Trading

(1.8 to 2.0%). This year, 1% of the

companies cut or expect to cut wages, similar to last year; more companies,

however, froze or expect to freeze wages, 23% compared to 13% in 2016. For next year 2018, the

wage increase will average 3.3% with 9% of the companies planning to freeze

wages and 1% planning to cut wages.

This year, large

companies paid or will pay wage increases of 2.9 to 3.2%, medium-sized

companies 3.0 to 3.4% and small companies 2.7 to 2.8%. For 2018, wage

increases are expected to be slightly higher. For 2018, the sector

expecting the highest wage increase is Education (4.0%) with Trading

continuing to be the lowest paying sector at 1.8 to 2.0%. Overall, Japan companies

paid or will pay the highest increases of 3.9 to 4.0%; and US companies the

lowest wage at 2.1 to 2.4%. For 2018, Japan companies continue to expect the

highest increases of 3.8 to 3.9%. 3.3 Variable

Bonus (excluding AWS) For 2017, 87% of companies

will pay variable bonuses averaging: 1.7 months for Managers 1.6 months for Executives 1.5 months for

Non-executives. Highest Paying Sector – Chemical & Related (2.6 to 2.9 months) Lowest Paying Sector –

Marine & Shipping (0.4 to 0.9 months) Large companies will pay

higher bonuses (2.1 to 2.5 months) than the 0.9 to 1.7 months of the small

and medium companies. For next year 2018, 80%

of companies expect to pay some form of variable bonus and the bonuses are

expected to be: 1.7 months for managers 1.6 months for executives

and 1.5 months for

non-executives.

The highest bonus paying

sector next year will continue to be Chemical & Related sector which

expect 2.4 to 2.6 months while the lowest paying sector, will be

Marine/Shipping sector at 0.5 to 0.8 months. In 2017, 91% of companies

paid an average of 1 month of AWS while for next year 88% of companies expect

to pay the AWS also averaging 1 month. 3.5 Recruitment In 2017, a total of 65%

of the companies hired or will hire staff, fewer than the 75% in 2016. For next year 2018, 51%

of the companies plan to hire staff. The average number recruited

or to be recruited per company in 2017 and the number to be recruited next

year are:

This year, 35% of the companies

froze or expect to freeze recruitment, compared to the 45% in 2016. For next

year, 28% of the companies expect to freeze recruitment. 3.6 Retrenchment 9% of the companies retrenched or plan to retrench

this year, compared to the 12% in 2016. For next year, none of the companies, so far, plan

to retrench. 3.7 Staff Turnover This year, so far, 81% of

companies experienced staff turnover. The annual turnover rate

for 2017 expected to average: 2% for Managers 4% for Executives and 6% for

Non-Executives. For next year fewer

companies (53%) are likely to experience staff turnover but the turnover rate

is expected to remain the same. 3.8 Total

Accumulated Monthly Variable Component (MVC) in % of Monthly Salary Slightly fewer companies,

56% compared to 60% in 2016, paid or will pay the MVC. The average

accumulated amount is slightly more than the 8.1 to 8.3% in 2016. In 2017 the

MVC will average: 9.8% for Manager 9.6% for Executives 9.4% for Non Executives.

3.9

Entry-Level Salaries

Entry-level

salaries for GCE ‘N’ and GCE ‘O’ decreased slightly by $20 to $40. Those

for PSC(Secretary), ISC(ITE Skills Certificate), Higher Nitec,

Diploma(Engineering), Degree(Others) and MBA increased by 2% to about 5%. GCE

‘A’, Nitec, Diploma(Other),

and Degree(Engineering), however,

remain unchanged. 3.10

Relevance of Strategies Recommended by Committee

on Future Economy (CFE) The Strategies that are relevant to companies

depend, obviously, on individual company circumstances and existing

strategies. The key ones and the proportion of companies that they apply to

are:

3.11

Other Strategies That Should Also be Considered For many companies

besides broad strategies, existing HR policies & practices also need to

be scrutinised and improved as indicated below:

If you wish to participate in any of our future surveys, click here |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

.

.